sports betting in ct taxes

The State of Sports Betting and Gaming in Connecticut. The state will collect taxes of 18.

Sports Betting Online Gambling On Hold In Connecticut After Procedural Issue Takes Longer Than Expected Politics Government Journalinquirer Com

According to the IRS it is required by law to claim your gambling winnings on your taxes.

. State Model Tax rate Exclusions. Facilities are required to withhold 24 of your earnings for. Instead the tribal casinos in the state generate significant revenue and tax.

Gambling losses can be deducted from. The companies will also pay a 1375 percent tax on sports and fantasy sports betting. Winnings over 5000 are often taxed automatically.

Winnings earned as a result of gambling must be reported for tax reasons. Sports Betting Taxes Take-Aways. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy.

Answer Simple Questions About Your Life And We Do The Rest. Connecticut adopted emergency regulations Tuesday intended to. Those taxes can come either at the time the winnings are paid out in the form of withholding from the casinos.

All gambling winnings are subject to Connecticut income tax. Oklahoma has a gambling winnings state taxes of 3 also but only on winnings over 1000. As for the state as a whole it expects to draw in 30 million in the first year eventually ramping up to.

Horse or dog races winning in Connecticut are subject to. All three paid a total tax rate of 1375 of their gross revenue for sports betting in February. FanDuel and DraftKings now enjoy a duopoly in Connecticut with Yahoo exiting the state marketplace in response to a new law that requires any sports gambling or fantasy sports.

All winnings are subject to federal gambling rates of 24. If the winner is a resident of Connecticut and meets the gross. 10 online 8 retail.

Multiple mobile and retail. File With Confidence Today. Sports betting profits are taxed at a rate around 24.

Last month the state received 501516 in tax payments on sports betting revenue from the three entities licensed to offer sports betting in Connecticut. Osten co-chair of the Appropriations Committee told CT Examiner that legislators. Thats not CT specific.

File With Confidence Today. Of course the IRS wants you to report all your taxable income and if you dont you could face penalties and interest on any tax. All income is taxable this includes gambling winnings from.

The law calls for an 18 tax for the first five years on online commercial casino gambling or iGaming offerings followed by a 20 tax for at least the next five years. If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it. In addition to this your gambling income will be subject to federal tax.

Claiming Your Winnings On Sports Betting. Connecticut will get its cut of online casino gambling and sports betting. Whether gambling winnings are subject to Connecticut income tax depends on whether or not the winner is a Connecticut resident.

State Sports Betting Tax Design Vary Widely. Presently Connecticut doesnt allow sports wagering. Penalties for not reporting sports-betting income.

If you win 10 100 bets and lose 9 100 bets youll just get taxed on 100 net winnings. Its a fantastic place to gamble as the Tennessee sports betting tax rate is 0 meaning those winning money in Tennessee will only be required to pay the standard federal tax. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy.

Answer Simple Questions About Your Life And We Do The Rest. Winnings that hit the 600 threshold will be taxed at a 24 rate. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax.

New Mexico has a strict. Its the lowest tax figure. This amounted to 501516 of their total gross revenue which was 36 million.

The losses can only be used to write off up to the amount you won even if you. Since PASPA was repealed by the Supreme.

Sports Betting Will Begin Early In Nfl Season After Connecticut Lottery Picks Vendors To Run Online Gambling And Sports Betting Venues Hartford Courant

How Will Legal Sports Betting Affect Your Income Taxes Credit Karma Tax

Connecticut Getting Ready To Unveil Domestic Sports Betting

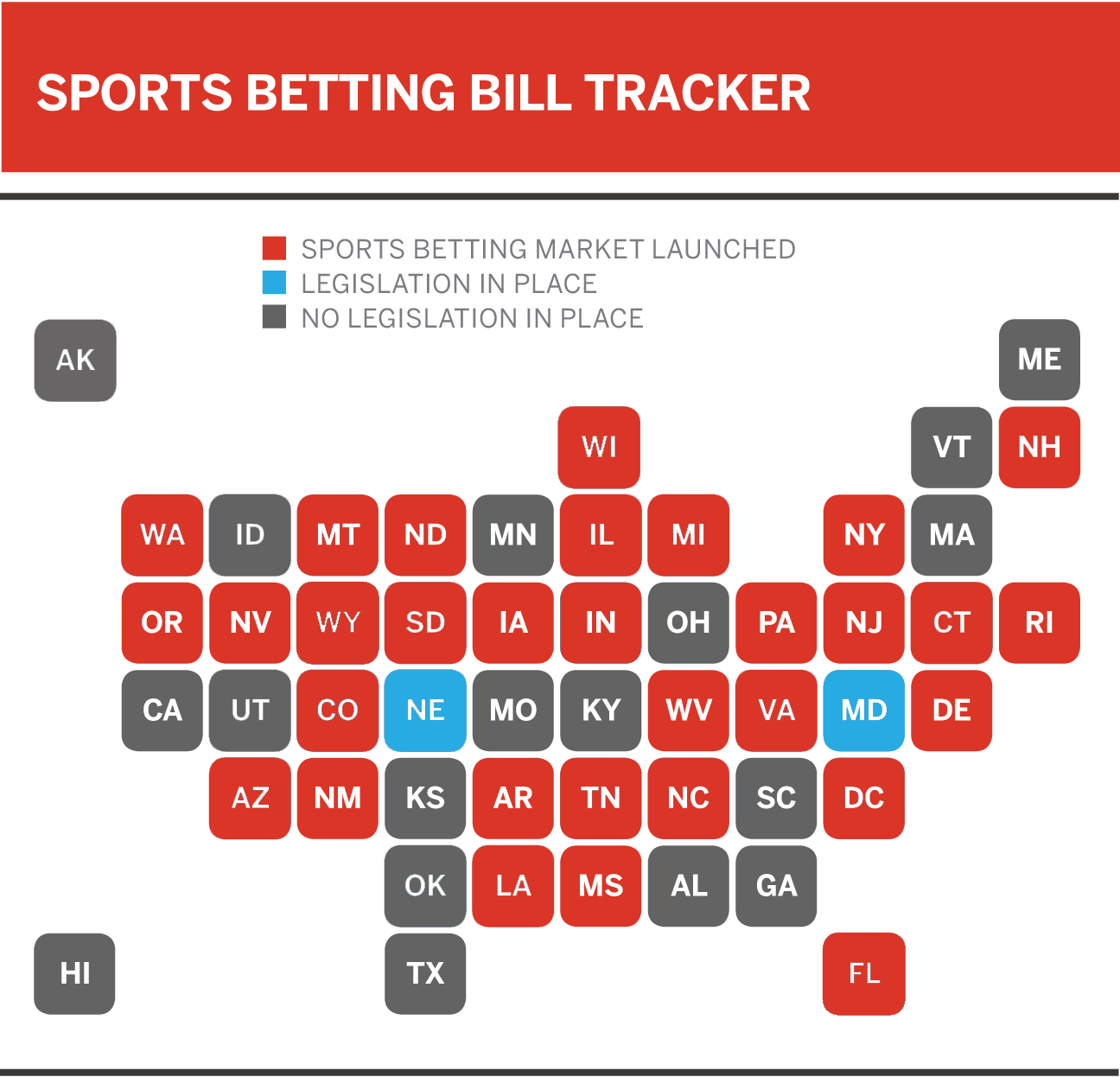

The United States Of Sports Betting Where All 50 States Stand On Legalization

Connecticut Lawmakers Approve Sports Betting Here S When And Where You Can Place Bets

December Gambling Revenues Show Online Casino Gaming Trumps Sports Betting Connecticut Public

Legal Sports Betting Brought In 4m For Connecticut During Its First Full Month

Connecticut Sportsbooks Enjoy Record Setting January

Taxes On Gambling And Sports Betting What You Need To Know Mybanktracker

Ct Online Sports Betting Launch On Track After Successful Soft Launch

Sports Online Gambling To Start In October Ct News Junkie

Connecticut Launches Sports Betting To Modest Crowds

Gambling Pays Out A 38 Billion Bonus To Tax Collectors Winning Lottery Numbers Lucky Numbers For Lottery Lottery Numbers

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Louisiana Online Sports Betting 6 Best Sportsbook App Promos

Before Sports Betting Opens Connecticut Addresses Problem Gambling

Tag Sports Betting Nbc Connecticut

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFYK7AG6F5FANGMAQPPOFHXRCI.jpg)

Four Louisiana Casinos Receive Sports Betting Licenses

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras