doordash business address for taxes

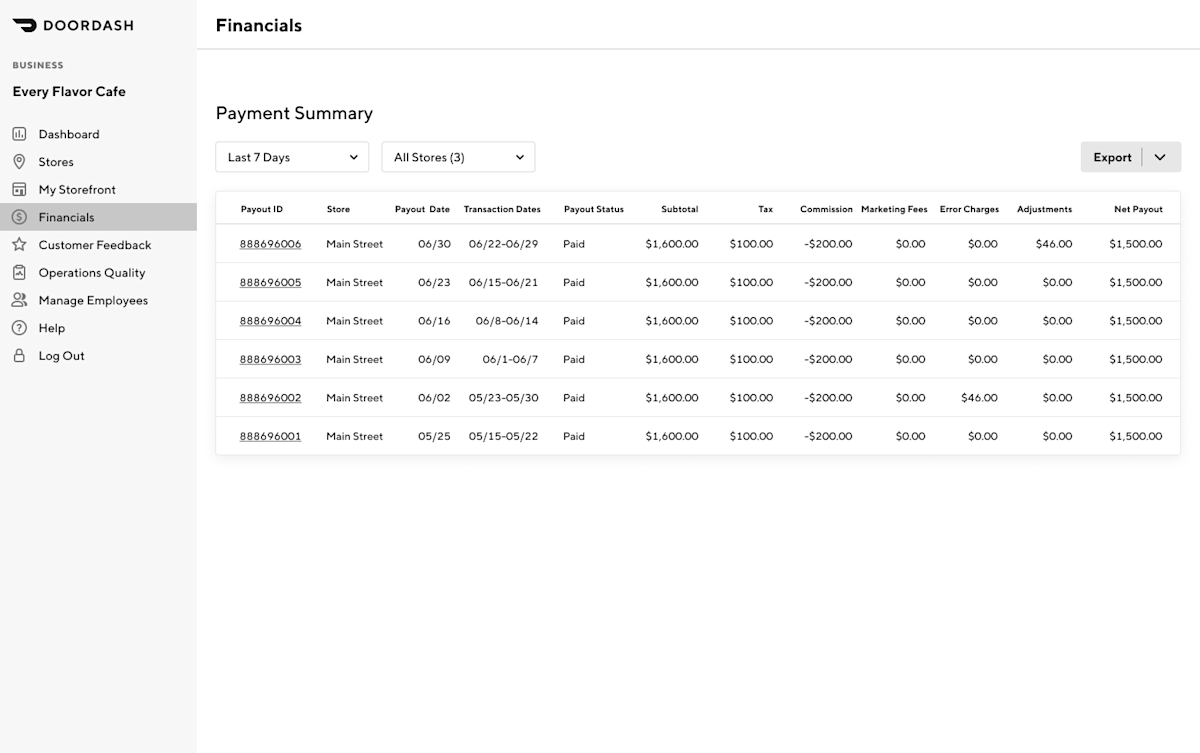

If your store is on Marketplace Facilitator DoorDash collects and remits sales tax on your stores behalf. Hot New Top Rising.

8 Essential Things You Should Know About Doordash 1099

Must have or create a valid DoorDash account with a valid form of accepted payment on file.

. As of December 2019 DoorDashs revenue is 900 Million. It usually ranges from 2-10 depending on the estimated time distance and desirability of the order. Actual phone numbers of customers.

Additional terms related to the Parties respective tax obligations may be set forth in the applicable Product Addendum. Unofficial DoorDash Community Subreddit. Now 245 Was 323 on Tripadvisor.

Fees taxes and gratuity still apply. But it forecast GOV of 800-850 million for Wolt in the second quarter - up 23-30 from 652 million a year earlier despite the stronger dollar but down from 888 million in the first quarter of 2022. 2 With DashPass youll enjoy unlimited deliveries from qualifying restaurants near you with 0 delivery fees on orders of 12 or more when you pay with your.

DoorDash cannot and will not provide tax advice. Deliveries that require Dashers to travel a longer distance that are expected to take more time and that are less popular with Dashers have a higher base pay. See 7470 traveler reviews 4149 candid photos and great deals for Pelican Grand Beach Resort ranked 17 of 142 hotels in Fort Lauderdale and rated 45 of 5 at Tripadvisor.

Weve joined up with DoorDash to bring eligible RBC credit cardholders this tasty treat. Use promo codes DOMO30 KING30 PIES30 MOON30 CAESAR30 to redeem. But that doesnt mean you cant do this yourself.

All deliveries subject to availability. Are DoorDash Uber Eats Postmates and Grubhub which owns Seamless. The 50 off discount will be applied.

According to The Sun the Road Traffic Regulation Act gives permission for police fire ambulance and other enforcement agency vehicles to break speed limits. Multiply by 153 business tax then thats what you owe. Lets have a look at DoorDashs current financials.

When the Queen prime minister and other members of the royal family are driven by police officers on official royal business they can drive as fast or as slow as they please. When are quarterly taxes due in 2022. File an income tax return in that state so you can get your money back.

If you have any questions about your own taxes please consult a tax professional. My acceptance rate is always under 50 but im making bank so who cares. Next youll need to determine where if applicable you need to file your taxes.

For more information on Marketplace Facilitator please visit our FAQ here. In the latest fundraising the company raised 400 Million. Right now DoorDashs market valuation is 16 Billion.

Promo code only valid in same state as recipients mailing address. You can get a great hourly wage by dashing around 20 per hour. Dashing can be a career.

Add the 3 months earned. Knowing the right DoorDash tips can make a big difference in your income. 1 DashPass Order Discount.

Names alone are fine as are maps without a name or address explicitly listed. Remember to pay the iRS quarterly taxes. The biggest names in food delivery apps in the US.

DoorDash has raised 24 Billion in total funding until now. Official Discord New Taxes Megathread Class Action Fast Pay. DoorDash has blown up in recent years and its still profitable in 2022.

It also said it expected the combined companies to make earnings before interest taxes depreciation and amortization EBITDA of 0-100 million. Filing Your Taxes. Base pay is DoorDashs base contribution for each order.

Each tax year is divided into four payment periods. Save Big On Delivery With DoorDash. Complimentary 3 months of DashPass from DoorDash.

I own an MLP and my K-1 has income in other states do I need to file. January 15 2022 was the deadline for quarterly payments on income earned from September 1 to December 31. Lets not do that.

To be eligible for this offer you must activate your DashPass membership with your Chase Freedom Unlimited Card Chase Freedom Card Chase Freedom Flex Card or Chase Freedom Student Card for the first time between 04012022 and 05312022 1159 PM PT. If your employer withheld taxes for a state where you didnt live or work dont panic. Pelican Grand Beach Resort Fort Lauderdale.

Most major tax software makes filing a Schedule E very simple - and if you use the same tax software from year to year it will easily allow you to keep track of your depreciation and more. The 47-year-old business owner from California is one of millions of Americans still waiting on a tax refund from 2020 after filing her return in. DoorDashs Net income as of December 2019 is 450.

Sales tax on your order based on applicable local tax laws. But if you just follow the official advice you might end up working for less than minimum wage. Post was informative on the mileagepay info on how you should accept or decline orders.

If youre a landlord filing your taxes can be a bit confusing. In such jurisdictions DoorDash will inform Merchant that DoorDash will remit any applicable taxes to the tax authority and DoorDash will be relieved of any responsibility to remit such applicable taxes to Merchant. A complimentary DashPass 1 subscription for up to 12 months a value of almost 120.

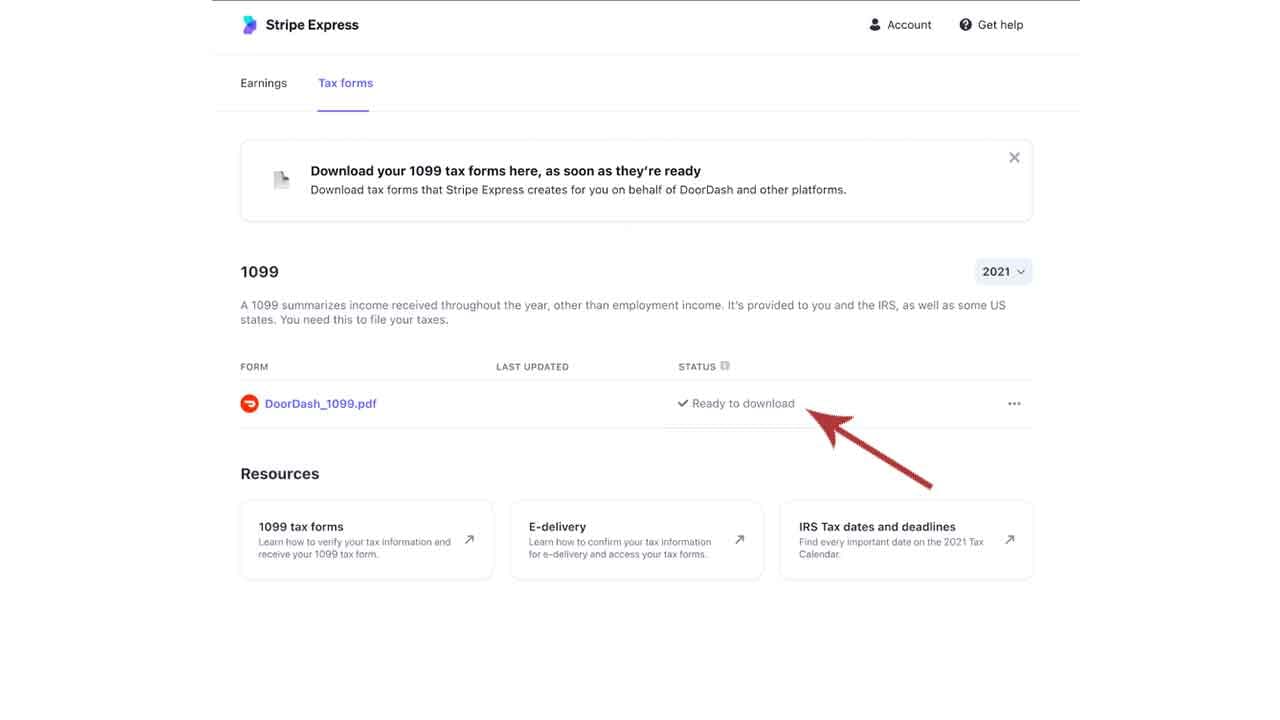

How To Get Doordash Tax 1099 Forms Youtube

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Charge Me For Tax When There Is None I Am From Montana Where There Is Currently No Sales Tax When I Place My Order However There Is Always A Tax On My

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

How To Do Taxes For Doordash Drivers 2020 Youtube

8 Essential Things You Should Know About Doordash 1099

Prepare For Tax Season With These Restaurant Tax Tips

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support